Bitcoin is trading almost $11,000 below its Aug. 14 record, according to CoinDesk data, but FalconX’s head of research says the market’s internal structure still looks “extremely bullish.”

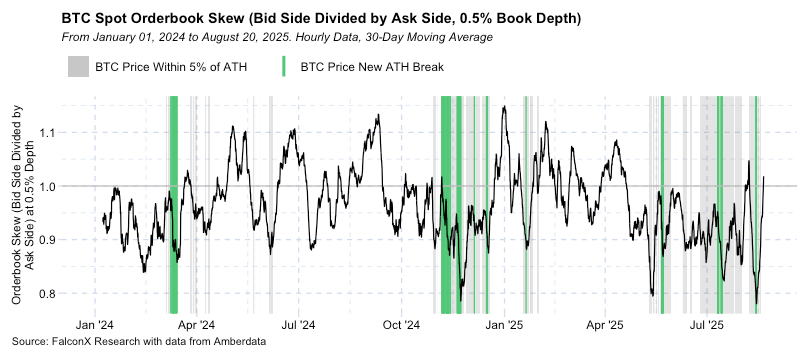

In a post on X on Wednesday, analyst David Lawant pointed to what happens in bitcoin’s order book — the live record of buy and sell offers on exchanges — when the price pulls back slightly from highs.

He explained that after these small dips, sell orders quickly disappear and buy orders take over, a dynamic he described as the order book “flipping” from the sell side to the bid side.

In plain terms, Lawant is saying that sellers are not sticking around to push the market down after modest declines. Instead, strong demand steps in almost immediately, and buyers crowd out sellers.

That pattern suggests long-term players with deeper pockets — such as institutions and well-capitalized funds — are using brief downturns as buying opportunities. Rather than signaling weakness, the absence of sustained selling indicates confidence in bitcoin’s longer-term trajectory.

The chart Lawant shared reinforces this interpretation. It shows periods where bitcoin slipped slightly from record levels, only for buy orders to quickly surge ahead of sell orders.

This repeated shift toward the bid side is a hallmark of a bullish market structure, since it demonstrates that demand is waiting in the wings to absorb any supply that comes to market. For traders, the takeaway is that bitcoin’s resilience after dips points to strong underlying support.

While bitcoin is still below its Aug. 14 peak of $124,481, the pattern highlighted by Lawant — sellers vanishing quickly and buyers reasserting control — continues to underpin bullish sentiment among analysts who see dips as opportunities rather than warning signs.

Technical Analysis Highlights

- According to CoinDesk Research's technical analysis data model, between Aug. 19, 17:00 UTC and Aug. 20, 16:00 UTC, bitcoin fluctuated within a $1,899.78 range, trading between a low of $112,437.99 and a high of $114,337.77.

- Around 13:00 UTC on Aug. 20, the price fell to $112,652.09 amid liquidation pressure before staging a strong rebound.

- The recovery was supported by high trading activity: 14,643 BTC changed hands, compared to a 24-hour average of 9,356 BTC.

- This surge established $112,400–$112,650 as a key volume-backed support corridor.

- In the final hour of the analysis period (15:47–16:46 UTC), bitcoin rose from $113,863.05 to $114,302.43 before closing at $113,983.06.

- The rally broke through resistance at $113,500, $113,650 and $114,000, aided by elevated volumes of 250+ BTC per minute, signaling the start of a short-term uptrend.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

https://ift.tt/06CXnEt

from CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data